Company News: Green Street Adds Advanced Sales Comps to College House, Driving Greater Platform Value

GREEN STREET NEWSROOM

Explore press releases, media coverage,

and industry news

Green Street’s Media Team support data requests, analyst interviews and commentary for: Green Street, IJGlobal, Local Data Company (LDC), Locatus, and College House. For media inquiries please contact media@greenstreet.com

Latest press releases from Green Street

january 15, 2026

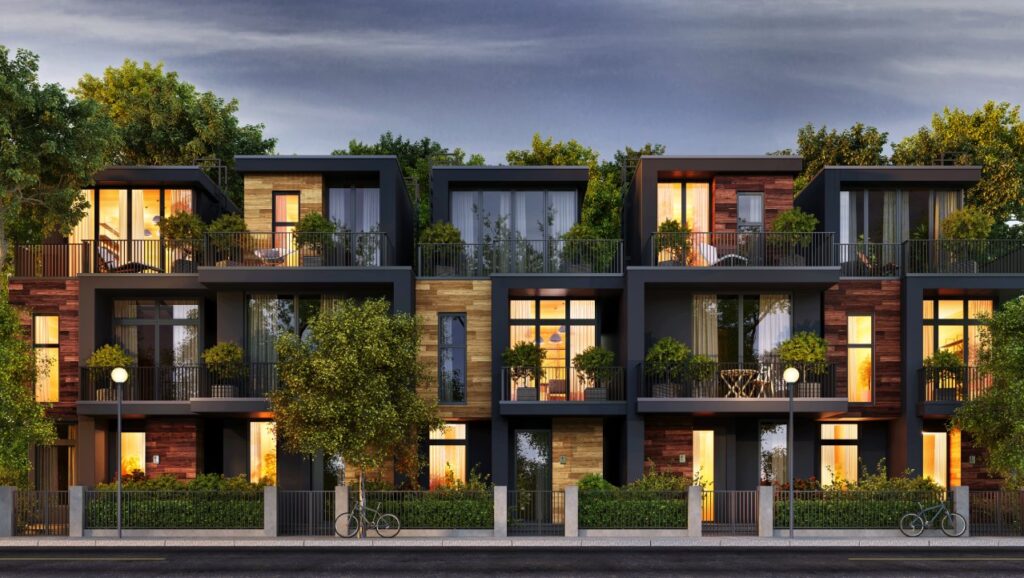

Green Street Adds Advanced Sales Comps to College House, Driving Greater Platform Value

OCTOBER 14, 2025

Green Street brings its Industry-Leading Public Market Research and REIT Data to Australia – Expanding Global CRE Intelligence

SEPTEMBER 30, 2025

Green Street Launches Next-Gen Retail Intelligence Suite Across UK and Europe

Green Street in the news

More Green Street press releases

-

United StatesThe enhanced feature unites crucial data in the student housing market to pave the way for seamless, smart decision making across sales, leasing and more Green Street, the leading provider of commercial real estate intelligence and analytics across North America, Europe, and Australia, today announced the launch of College House Sales Comps, a new feature delivering deeper, data-driven, property-level […]January 15, 2026

-

EuropeUtrecht – 2 February 2025 –Last year was the 17th year in a row that Locatus, a Green Street company, inventoried all Belgian retail locations and charted the changes. This allows us to track developments within the Belgian retail landscape. Including one of the most visible developments, the sharply increased vacancy rate. After our first […]February 2, 2025

-

EuropeIn addition to 5 European sector reports, team publishes second annual Global Data Center Report London – 6 February 2025 – Green Street, the leading provider of trusted commercial real estate intelligence and unbiased insights, has released its 2025 European Sector Outlooks, providing forward-looking insights into market fundamentals and valuations across five key property sectors: […]February 6, 2025

-

United StatesExplore market fundamentals and valuations across 10 key property sectors Newport Beach, CA – February 6, 2025 – Green Street, the leading provider of trusted commercial real estate intelligence and unbiased insights, has released its annual U.S. Sector Outlooks, providing forward-looking insights into market fundamentals and valuations across nine key property sectors: apartments, industrial, lodging, […]February 6, 2025

-

CanadaFirm releases inaugural Canadian Sector Outlook report alongside a host of proprietary public and private market valuation data and analytics TORONTO, Ont., February 26, 2025 – Green Street, the leading provider of trusted commercial real estate intelligence and unbiased insights, has expanded its Canadian market coverage with new private market research and data, plus expanded […]February 26, 2025

-

AustraliaGlobal News Offering Now Covers More Than 20 Countries On 3 Continents Newport Beach, Calif., March 13th, 2025 – Green Street, the leading provider of trusted commercial real estate intelligence and unbiased insights, has acquired Australian Property Journal – Australia’s premier publication for commercial property and residential real estate covering REITs, investment sales, and leasing […]March 13, 2025

-

EuropeRetail Resilience: Great Britain’s Store Closures Hit Second Lowest Level in a Decade in 2024 London, 20 March, 2025 – PwC has revealed its latest tally for chain retail stores, leisure venues and service outlets opening and closing across Great Britain for 2024. The bi-annual report using proprietary data from Green Street, tracks over 200,000 […]March 20, 2025

-

EuropeFirm releases comprehensive macro insights into the European self-storage sector, via its latest Outlook report LONDON, 13 May, 2025 – Green Street, the foremost provider of commercial real estate intelligence and insights, has expanded its private market research coverage to the European self-storage sector. Utilising 5 years of forecasted insights and 10 years of historical […]May 13, 2025

-

CanadaExpanded sector coverage and analytics provide deeper, actionable insights TORONTO, Ont. – June 10, 2025 – Green Street, the the leading provider of trusted commercial real estate intelligence and unbiased insights, has expanded its Canadian private market data capabilities across 10 key markets and four sectors: Apartment Industrial, Office, and Retail. The new enhancements empower […]June 10, 2025

-

United StatesExpanded sector coverage and analytics provide deeper, actionable insights NEWPORT BEACH, CA – June 26, 2025 – Green Street, the leading provider of trusted commercial real estate intelligence and unbiased insights, has expanded its U.S. Market Data and Deals platform with the full coverage of Data Centers and Lodging, bringing the total sectors under coverage […]June 26, 2025

-

Green Street’s latest acquisition accelerates our commitment to expanding property-level data and analytics across sectors and geographies, and…June 26, 2025

-

AustraliaOur global news coverage has just expanded into Australia. Expand your insights with exclusive CRE news from a team of on-the-ground journalists…June 26, 2025

-

GlobalA Single Solution for Global Infrastructure Investing with Full Lifecycle Visibility LONDON, UK – 24 July 2025 – Green Street, the leading provider of trusted real asset intelligence and unbiased insights, has significantly enhanced IJGlobal following its acquisition in September 2024. IJGlobal now seamlessly integrates market-moving news with extensive data on transactions, assets, funds, and […]July 24, 2025

-

United StatesNewport Beach, Calif. – July 29, 2025 – Green Street, the preeminent provider of commercial real estate intelligence and analytics in the U.S., Canada, Europe, and Australia, today announced the acquisition of College House, a leading provider of property-level data and insights for the U.S. student housing sector. Founded in 2019, College House has built a […]July 29, 2025

-

GlobalFirm now delivers integrated public and private market intelligence across four continents, and expanded sector coverage with the acquisition of College House NEWPORT BEACH, Calif. – September 10, 2025 – Green Street, the leading provider of trusted commercial real estate (CRE) and infrastructure intelligence, predictive analytics, and unbiased insights, is celebrating its 40th anniversary as […]September 10, 2025

-

EuropeEnhanced retail analytics offer powerful tenant & investor insights as retail real estate rebounds. LONDON, UK. – September 30, 2025 – Green Street, the leading provider of trusted commercial real estate (CRE) and infrastructure intelligence, predictive analytics, and unbiased insights, today announced the launch of its next-generation retail intelligence suite, for the UK and European market, […]September 30, 2025

-

AustraliaSydney, 14 October 2025 — Green Street, the leading provider of trusted commercial real estate (CRE) and infrastructure intelligence, predictive analytics, and unbiased insights across North America and Europe— has officially launched its Australian Public Market Research and REIT Data product, bringing unrivalled insights into one of the world’s most dynamic real estate markets. The […]October 14, 2025

2025

More Green Street in the news

TESTIMONIAL*

“Hands down, Green Street has the best data & analytics of any CRE research firm. Their credibility is second to none. With Green Street’s insights we make better strategic business decisions.”

Bruce Choate

Director & Board Member, Watson Land Company