Drinking from a Firehose: Digesting Data in the CRE Space

Adapting to the Shifting Data Landscape

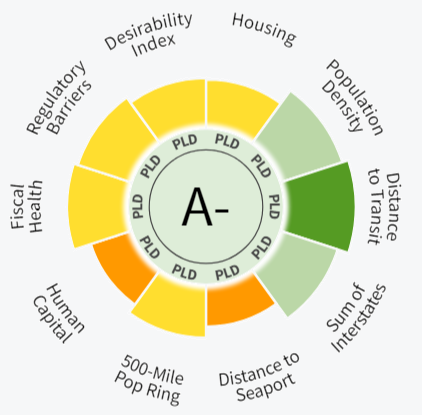

The explosion of data has pushed market participants to adapt how they approach commercial real estate research. Fifteen years ago, acquiring data beyond a market or Metropolitan Statistical Area (MSA) was extremely difficult. The opposite is true today, and the new challenge is finding ways to manage and digest the vast amounts of data available. Green Street employs the same basic relative value framework it did two decades ago to help clients weigh the attractiveness of property sectors, markets, and REIT stocks. What has changed is that we are now required to get much more granular in our analysis. As an example, we grade the land under every single REIT-owned asset to better assess differences in long-term growth prospects across the different portfolios. The resources required to design these complex grading algorithms - and to gather the data that feeds them - are immense and involve a wide array of skillsets. While Green Street continues to employ talented analysts with traditional real estate, finance, and economics backgrounds, we have also hired an army of specialists from the technology and data science fields.

REIT Markets Still Aren’t Fully Efficient

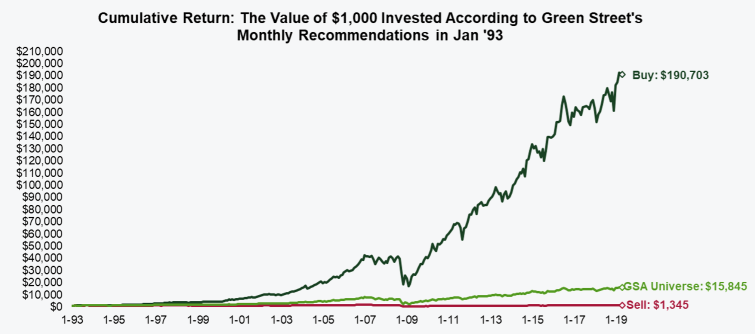

As information becomes more widely available and market transparency improves, the “potential” alpha available through active management declines. This has certainly happened in the REIT space. REIT investment managers have the added headwind that companies have also become more homogeneous in terms of property holdings, management acumen, and balance sheet structures. Yet, the REIT market isn’t fully efficient, and managers can still create alpha through stock selection. The explosion of available data does not mean all that data is just sitting out there in usable form. Those armed with the resources to gather, clean, organize, standardize, and decipher the vast amount of information are still afforded the opportunity to identify market mispricing. Additionally, there are elements of REIT valuation where data remains opaque and requires expert analysis to be done manually. This includes valuing non-stabilized assets, development, land holdings, and off-balance sheet joint ventures. Getting the valuation correct on all this "other" stuff beyond the stabilized assets can move the needle with respect to alpha capture. Learn more about Green Street's track record.

Mixing the Old with the New

The shifting data landscape means that commercial real estate professionals must adjust how they analyze and underwrite properties. Green Street has expanded its product suite to include a host of advanced mapping, analytics, and data offerings to help our clients more effectively turn the world of information into usable intelligence. That said, it does not mean that some of the more traditional approaches to research are obsolete. There are many important questions less suited to be solved by “big data”, such as assessing the impacts of changing tax policy, capital expenditures, and the myriad of potential disruptors (ecommerce, driverless cars, co-working, etc.) that will impact future investment performance. Green Street will continue to produce traditional research reports that explore these topics. Despite the rapid growth in available data and advances in artificial intelligence, machines have yet to replicate the intuition and "gut feel" of the analyst – which will continue to add value long into the future.

Related Resources:

Learn more about our insights

Our thought leadership helps thousands of clients make better investment decisions every day. Inquire here to learn more about Green Street’s product suite.

More Stories

Canada

Canadian Retail Sector – Keep it Simple

Retail Sector

High Street Rental Auctions: A new Lever for Revitalising Town Centres

strip centers