Company News: Green Street Releases 2026 Annual Sector Outlooks Delivering Critical Market Insights

Looking For Growth Amidst Niche Sector Evolution

Commercial real estate investors define multifamily, office, retail, and industrial as “core” sectors. Demand drivers are well studied, tenant bases are diversified, and cash flows tend to be predictable. These characteristics make core sectors highly investable in the eyes of institutional capital, creating deep, liquid markets that reinforce their perceived safety and attractiveness – a self-fulfilling cycle. This feedback loop benefits the broader investment landscape, as commercial real estate has become a fixture of diversified portfolios.

While core sectors form the foundation of institutional real estate investment, they represent only part of the landscape. Beyond them lies a myriad of “niche” sectors, property types reflecting some combination of specialized uses, fragmented ownership, and operationally complex business models. This is starkly different from what characterizes core sectors, which is precisely why there is greater uncertainty and perceived risk with these property types. As a result, institutional capital historically remained limited, creating opportunities for early players to exploit supply-demand inefficiencies and favorable pricing before the broader market caught on.

Niche sectors with strong underlying fundamentals have gained widespread acceptance in the last decade or so, with increasing supply, lower return requirements, and institutional roll-up strategies becoming commonplace. Property types once considered to be on the fringe of commercial real estate have now become mainstream, spurring investors to chase the next big opportunity.

This blog will examine:

- How niche sector returns (both expected and realized) have historically compared to core

- The cap rate and GAV Premium compression that followed institutional adoption

- How excess supply has emerged in certain sectors as competition intensified

Historical Return Expectations and Outperformance

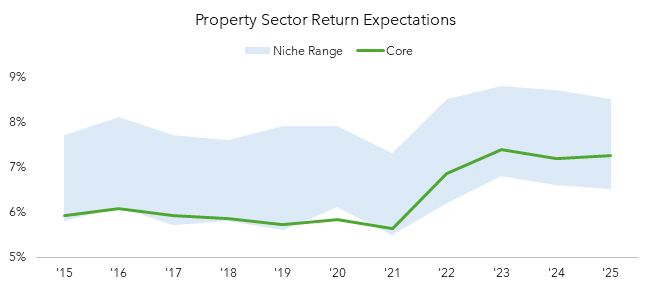

The outsized returns investors have historically generated by being early to niche sectors justify the pursuit of this opportunity. Year by year, the range of niche sector return expectations has trended above the core average. Top niches, such as Self-Storage, Manufactured Homes and Senior Housing, frequently were priced with expected returns well above the core benchmark, while even the lower end of the niche return spectrum remained near core (Figure 1).

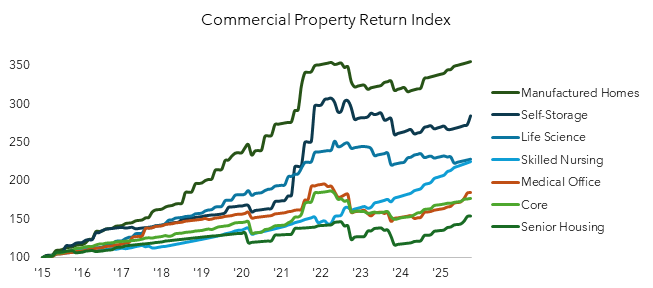

In the prior decade, niche sectors carried a risk premium due to their defining characteristics. Yet those same traits created opportunities, as niche properties often captured structural growth trends that core assets could not (i.e. aging population benefiting senior housing and expansion of student debt reinforcing demand for student housing). Over time, as niche sectors realized consistent performance, and institutional capital began to flow in, demonstrating growing confidence and increasing competition for these assets (Figure 2).

Niche Sector Cap Rates

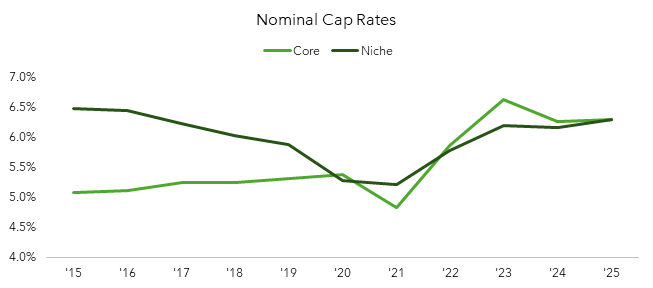

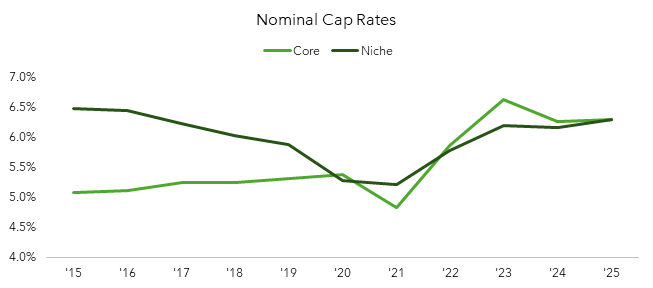

With growing investor competition comes cap rate compression. As more institutional investors with lower costs of capital bid for a given asset, upward pressure is placed on the purchase price, while NOI remains unaffected, driving cap rates lower. The momentum created by this crowding further reinforces liquidity, often adding additional downward pressure on cap rates.

This market behavior has been observable in recent years. Between 2015 and the onset of Covid lockdowns, niche sectors experienced material cap rate compression as investor interest and transaction volumes increased. Yields on many niche property types tightened by over one hundred basis points, while core sectors, by contrast, saw cap rates expand marginally on average (Figure 3).

Today, the spread in cap rates between core and niche has largely vanished. The higher yields that once compensated investors for the unique risks of niche sectors disappeared, reflecting heightened desirability, growth expectations, and leaving little incremental premium for new investors, on average.

Gross Asset Value Premiums

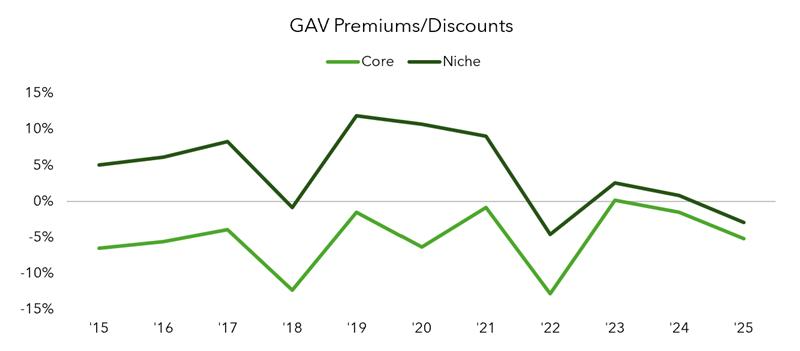

Gross asset value (GAV) premiums and discounts reflect the degree to which publicly traded REIT investors are willing to pay more for REIT’s shares than the underlying real estate value. Historically, niche sectors have tended to trade at premiums to GAV, as public-market investors priced in growth potential before new private market entrants. Over the past decade, however, these premiums have compressed significantly, alongside private-market cap rate compression, reflecting greater consensus on asset values and increased competition for acquisitions. In other words, the private market caught up.

Core sectors, by contrast, have exhibited relatively consistent GAV discounts, as their established performance history and transparent markets limited potential for outsized appreciation relative to the niche space. The convergence in niche sector premiums demonstrates how initial information asymmetries and perceived risk gradually dissipate as sectors mature (Figure 4).

The story of Manufactured Housing exemplifies this. In 2015, GAV premiums were roughly 18%, reflecting the early-adopter advantage. By 2019, premiums had expanded to 25% as REIT investor interest accelerated. Today, Manufactured Housing trades near a 10% discount to GAV, indicating that the market has largely internalized the value of these assets (Figure 5). The rapid reversal demonstrates how previously niche sectors can transition to competitively priced sectors once performance is proven.

Excess Supply

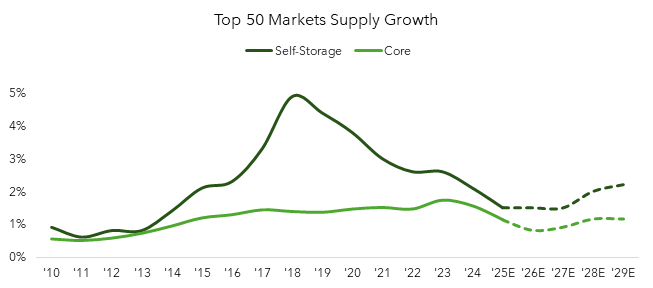

Niche sectors now comprise a meaningful share of institutional portfolios and, in many respects, are no longer “niche” at all. This normalization introduces new challenges, as accelerated capital formation can outpace demand, particularly in sectors with minimal barriers to new supply.

Self-Storage is a prime example. Prior to broader institutional recognition of its core-like qualities, supply growth across the Top 50 markets averaged under 1% (Figure 6). Once a broader cohort of investors flooded in to chase the opportunity, supply surged, eventually overcrowding the investment landscape and compressing opportunity. By contrast, Manufactured Housing demonstrates that this pattern is not universal; meaningful zoning constraints and NIMBYism have historically limited new supply, preventing the same overcrowding effect.

Finding Opportunity In Niche Sectors

Most institutional real estate investors operate in markets and sectors that have already been proven out by the amount and frequency of capital deployed. While liquidity and relative safety in numbers may provide more certainty in execution, niche sectors have historically delivered outsized returns. A historical lack of information, lack of institutional interest, and otherwise favorable underlying industry drivers have driven past outperformance, but the timeline for institutional adoption and the associated window of opportunity have both narrowed as investors are continually searching for the next new sector.

Opportunities that initially seem overly complex or unconventional may carry higher risk but have proven their ability to deliver outsized returns before broader institutional adoption occurs. Investors who were willing to engage early were often rewarded, which is why emerging niche sectors should be central, not peripheral, to an investor’s focus.

Bayle Smith

—————————————————————————————————————————————