Company News: Green Street Releases 2026 Annual Sector Outlooks Delivering Critical Market Insights

GSN Roundup: ABS Issuance, RXR Refi, and San Francisco Office Discounts

Top stories in US CRE News this week:

Asset Backed Alert – 10.03.2025

September ABS Issuance Breaks Record

There never has been a bigger September for issuance of asset-backed securities in the U.S.

During the month, issuers in the States priced $35.3 billion of such securities, according to Asset-Backed Alert’s ABS Database. It was the most active September ever, breaking the month’s previous record of $33.8 billion set in 2006, during the runup to the global financial crisis.

The burst of dealflow last month came in part due to the breaking of a logjam of securitizations that had built up in August, when many issuers put offerings on hold until after Labor Day. Issuance volume built steadily after the month’s first, holiday-shortened week, including during the span of Sept. 8 to 12, when 26 asset-backed bonds priced totaling $19.7 billion — setting a record for the most issuance in a week.

The Federal Reserve’s Sept. 17 decision to slash its interest-rate targets by 25 bp also helped, enticing some issuers to market. Even before the cut, issuance costs have fallen throughout the year.

For instance, on Sept. 23, Ford priced a $1.5 billion securitization of prime-quality auto loans via bookrunners Barclays, BMO Capital, Lloyds Banking, RBC and TD Bank. The offering’s triple-A-rated, one-year top class printed at 30 bp over the I-curve to yield 3.9%. A similar slice from a deal Ford priced on March 18 landed at 41 bp over the benchmark to yield 4.5%.

Bonds backed by prime-quality auto loans comprised the largest chunk of September issuance, accounting for $4.9 billion of the tally. Securitizations of student loans were next, at $4.3 billion, followed by auto-lease securitizations, at $3.7 billion, deals underpinned by subprime auto loans, at $3.3 billion, and credit card-backed offerings, at $2.8 billion.

Student-loan securitization volume was aided by a $2.5 billion transaction from Nelnet backed by private accounts that priced on Sept. 12.

Also in September, $2.0 billion of deals backed by whole-business cashflows priced, including a $1.5 billion offering from Taco Bell that crossed the finish line on Sept. 9.

Through Sept. 30, U.S. issuers have priced 429 asset-backed bond offerings this year totaling $263.4 billion, compared with 408 securitizations adding up to $261.6 billion at the same point last year.

Commercial Mortgage Alert – 10.03.2025

RXR Seeks Refi of Lexington Avenue Offices

RXR has begun exploring options for refinancing its office property at 450 Lexington Avenue in Manhattan to the tune of about $400 million.

The firm is talking to lenders about a new loan via Walker & Dunlop, and is apparently open to various options regarding what shape the debt could take.

The collateral is a long-term leasehold interest in roughly 950,000 sq ft on the upper floors of the property, which is adjacent to Grand Central Terminal. The space is fully leased to a roster of tenants with a weighted average remaining term of more than 19 years.

Most of the loan proceeds would be used to retire an existing mortgage. Pacific Life provided a $325 million loan on the building in 2012 — an agreement that was modified in 2019, according to public records. The nature of the modification isn’t clear, but the debt appears to remain in place.

That loan financed New York-based RXR’s $720 million purchase of the leasehold interest from Istithmar, an investment vehicle for Dubai’s royal family. It was reported at the time that RXR had acquired about half of $600 million of maturing debt on the property, a position it used to push for sale negotiations. In 2016, RXR, led by Scott Rechler, weighed selling a roughly 50% stake, but ultimately opted not to move forward.

The building is on the southwest corner at East 45th Street, across from the MetLife Building. It was completed in 1992 by a partnership between Sterling Equities and Hines.

The underlying ground and the lower eight floors of the building are owned by the U.S. Postal Service. A historic post office constructed in the early 1900s previously stood on the lot, and its structure was incorporated into the new tower when it was developed.

The largest tenant on the upper floors is law firm Davis Polk, which has maintained its headquarters there since the building was completed. The firm occupies more than 700,000 sq ft — or about 75% — of the space and two years ago signed a lease extension that runs until 2049. Other tenants include private equity shop Warburg Pincus.

In the wake of Davis Polk’s lease extension, RXR mapped out a major renovation program in the coming years that could cost upward of $300 million. Plans include renovations of the lobby and elevators, along with upgrades to mechanical systems and the facade.

RXR’s lease on the underlying ground runs until 2103.

Real Estate Alert – 10.07.2025

San Francisco Offices Listed at Big Discount

A distressed office tower in downtown San Francisco hit the block last week with pricing expectations around $250 million, setting the stage for the recovering city’s largest office trade in three years.

Shorenstein and Blackstone own the 620,000 sq ft, Class-A building at 45 Fremont Street. Eastdil Secured is running the marketing campaign on behalf of the duo and its lender, Bank of America.

The parties are offering the property as a deed-in-lieu-of-foreclosure deal, giving a buyer full control. Bids are expected to range from the high-$300/sq ft to low-$400/sq ft area. A trade at the midpoint would mark about a 50% discount to the roughly $500 million valuation the tower received when it was refinanced with a $347 million BofA loan in 2019.

The 34-story building is about 65% occupied, with a weighted average remaining lease term of six years. The pitch is that a buyer coming in at the heavily discounted basis would benefit from the stability of the existing rent roll while being in a stronger position to lease up vacant space.

The property was built in 1978, and San Francisco-based Shorenstein has owned at least a stake in it since the mid-1980s. In 2017, Blackstone bought a 49% interest from MetLife Real Estate Investors, with Shorenstein retaining 51%. That transaction valued the property at $415 million.

The owners since have invested $80 million in improvements, including a 2022 renovation.

The San Francisco Business Times reported in April that Shorenstein and Blackstone were planning to put 45 Fremont up for grabs at the direction of BofA and had hired Eastdil. The article did not include the timing of the launch or the whisper price.

The tower, which is designated LEED platinum, is in the South Financial District, within a few blocks of the Salesforce Transit Center, the Ferry Building and the waterfront.

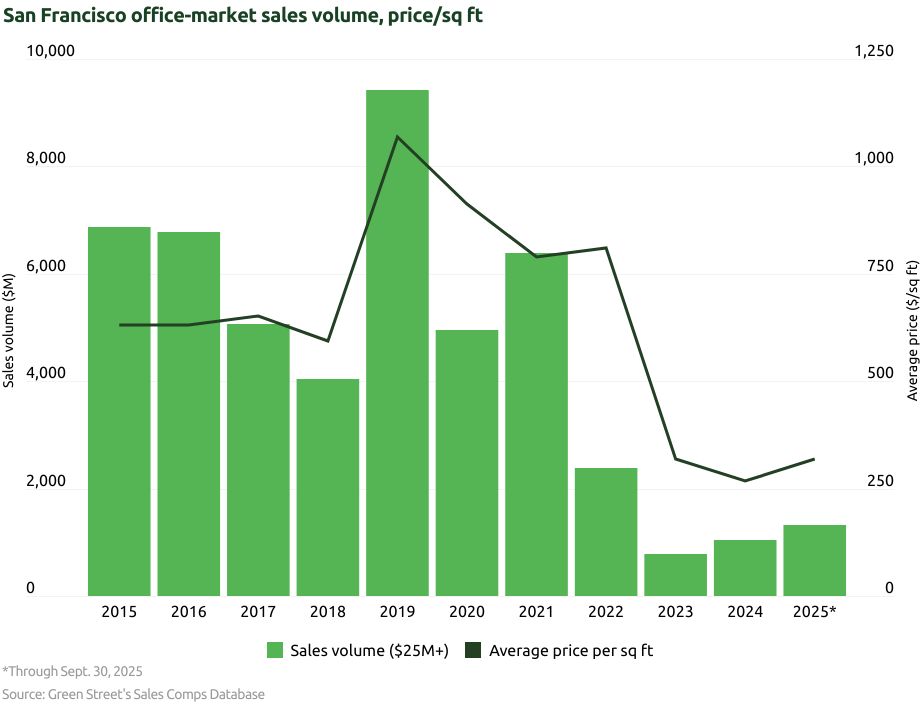

The listing comes as sales in the San Francisco office market are starting to recover. Local trades worth $25 million and up totaled $1.3 billion through the end of September, surpassing last year’s annual total of $1 billion, according to Green Street’s Sales Comps Database. Moreover, the average valuation on trades so far this year is $319/sq ft, up 19% from last year, when pricing bottomed out at $268/sq ft.

This year’s largest San Francisco office trade came in May when the 767,000 sq ft Market Center changed hands at about a quarter of its previous sale price. In that deal, a DRA Advisors partnership paid $185 million, or $241/sq ft, for the distressed downtown tower, representing a staggering $537 million discount to the $722 million that Paramount Group paid for it in 2019.

Eastdil marketed the property for Paramount and its lender, ING.

That sale was the largest San Francisco office trade since April 2022, when CalPERS and DivcoWest paid $356 million, or $1,100/sq ft, for Old Navy’s former 318,000 sq ft headquarters at 550 Terry A. Francois Boulevard. In the intervening years, cutbacks by technology companies, the remote-work trend and high interest rates sent occupancy, sales and valuations down sharply.

However, the city’s office market is starting to rebound. Green Street said in a report updated this month that firms in the growing artificial-intelligence sector are leasing big chunks of office space, and recent state and city elections “provide potential green shoots in real estate fundamentals.”

“Safety, vibrancy, and homelessness have improved meaningfully in the past year and seem to indicate the market is on a more positive trajectory,” the firm added.

Newmark, in a midyear report, projected that growth would continue as more startups receive venture capital funding tied to AI development. That also will bolster the office-sales market.

“Driven by improving sentiment towards San Francisco, distressed office assets will continue to trade hands, though at less of a discount than in the past several years as buyer pools increase,” the brokerage said.