Company News: Green Street Releases 2026 Annual Sector Outlooks Delivering Critical Market Insights

Data Centers: Value Mines in a Shovel Market

Artificial Intelligence (“AI”) infrastructure has been the darling of the real assets space in recent years. Individual data center leases are now measured in gigawatts, no longer megawatts, and costs have incrementally grown by the billions as cloud services and AI demand have combined to create a historical need for space and power. Data continues to be created at an accelerated pace. The role of the data center has expanded from storage to training and inference (each with exponentially more intensive power requisites). As market participants have begun questioning the durability of this demand, data center investors would be prudent to spend their time defining the characteristics of what makes a good data center market to ensure they are insulated from potential distress amid this “endless” data center bull market.

Data Center Basics

In short, data centers house computer servers that deliver varying solutions depending on the ultimate use case of the tenant. Colocation and hyperscale data centers, which comprise an overwhelming majority of the global supply, house AI and traditional data storage. Network-dense data centers are interconnection-rich colocation facilities which are inherently difficult to replicate due to their unique ecosystem.

In a typical data center deal, the landlord owns the land, building, shell and accompanying “longer-life” infrastructure (e.g., generators, batteries, cooling equipment and power equipment). The tenant typically owns the “short-lived” infrastructure (e.g., computer servers, networking equipment and storage.

The computer servers installed within these facilities consume power at an increasingly insatiable rate as they function to process the mounting demand for computing power. Power measures the capacity of an electrical system to deliver energy at a given moment. This, instead of building square footage, is the standardized metric of scale in the data center space because power is the ultimate limiting factor for a modern facility.

Valuable Data Center Market Traits

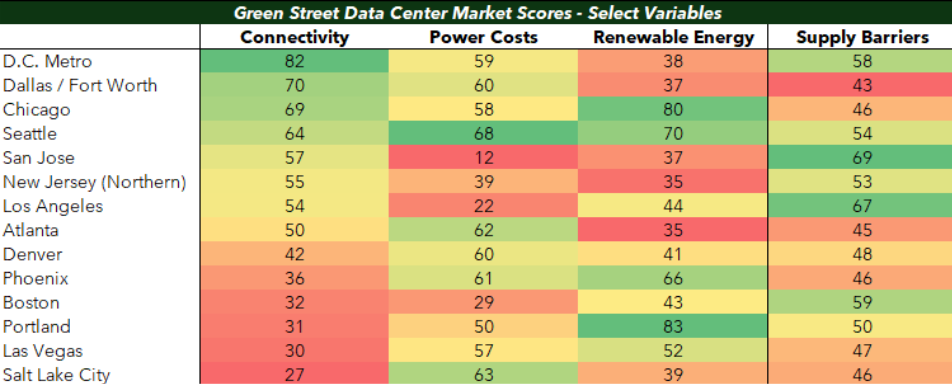

In early 2024 Green Street developed a market grade methodology to attempt to quantify market quality in terms of long-term rental growth potential. Four of the ten components used in the calculation are listed below, three of which are unique to the data center sector.

Source: Green Street

Connectivity Score measures the number of network providers meeting in each market to exchange internet traffic. The internet relies on connections between a diversified array of high-tech telecommunication lines (fiber optic cables) that are owned/operated by multiple parties. A market with strong connectivity provides access to multiple providers to transmit data between these parties. Access to such a market reduces latency concerns and creates a reliable data transmission ecosystem.

Power Costs Score measures the average costs of utility power (in kWh) for commercial use. A data center’s power costs represent a high percentage of an asset’s total operating expenses. While landlords are typically reimbursed for power costs, it is easier to attract and retain tenants when you can offer them a more attractively priced option.

Renewable Energy Score measures the percentage of energy supplied in a market that comes from renewable sources. Most hyperscalers (i.e., largest data center tenants), including five largest, have made public commitments to become carbon neutral, or even “carbon negative” with respect to their emissions from operations. Data centers that offer renewable energy sources help these hyperscalers maintain or meet their emissions goals.

Supply Barriers Score measures the degree of legislative and geographic barriers to building new supply in a market. As local municipality energy prices and availability come under more scrutiny, new community barriers, often described as “not in my backyard” (“NIMBY-ism”), may become higher impediment to new developments.

Primary Market Rise to Fame

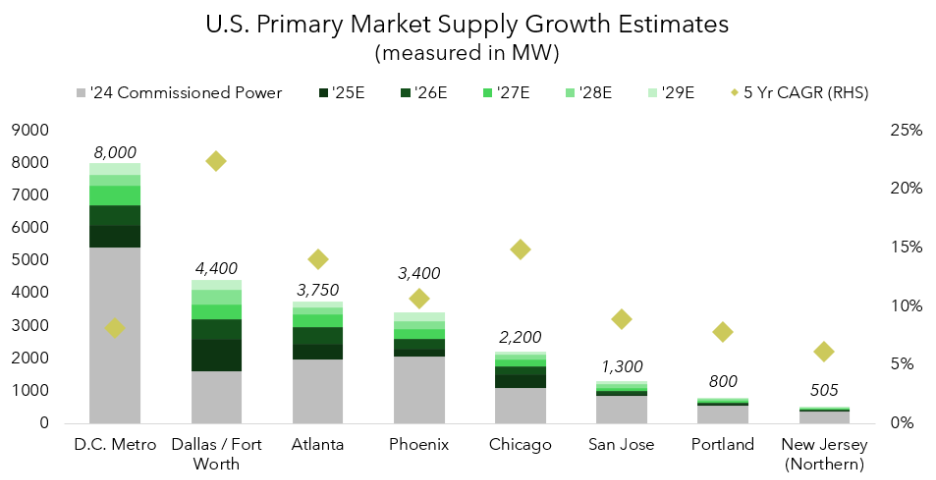

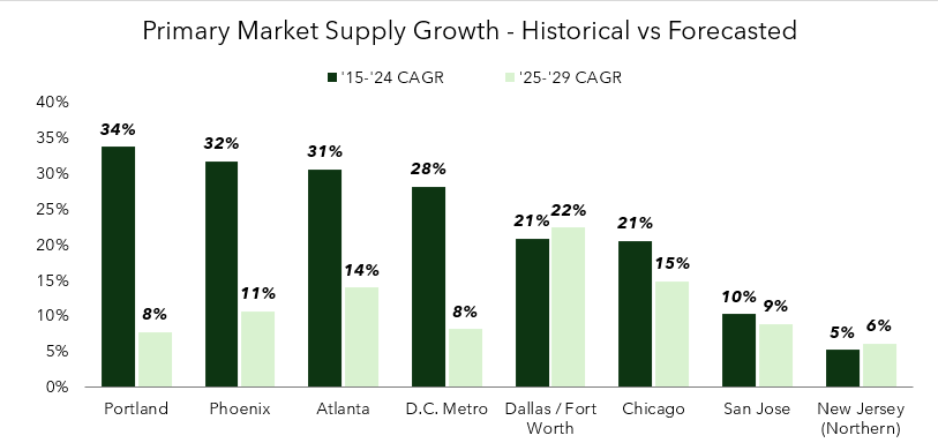

Source: Green Street

Source: Green Street

The primary data center markets in the U.S. (shown above) have a combined ~14GW of supply as of ’24 YE. So, what qualities did these popular regions display that facilitated their rise to market domination?

The largest market in the country, Northern Virgina (included in the D.C. Metro) has historically met all of the desirable qualities of a good data center market. In addition to having below average power costs, reliable grid, and friendly tax incentives, it offers a massive concentration of fiber-optic cables. The market’s unique digital ecosystem provides a ‘network effect’ where the scale and proximity of telecommunications companies and cloud on-ramps make it one of the premier destinations for data distribution.

Phoenix is the closest competitor to Northern Virgina in terms of absolute capacity, despite having less than half as much power commissioned as of ‘24 (~2,050 vs 5,400 MW). The region has offered a natural disaster-safe and low humidity environment that dramatically reduces the risk to equipment. Moreover, Phoenix’s proximity to the West Coast allows it to act as cost efficient alternative with sufficiently low latency for California-based companies.

Primary Markets Gaining Momentum

So, what makes for a desirable data center market in today’s environment? The answer depends on what the end use is for the tenant. Some markets are more conducive to cheap power and quick “time-to-power” (i.e., time needed to deliver power to the site during development), while other markets offer low latency and strong connectivity. Additionally, as regional grids become further stretched, municipalities have become less welcoming to the potential windfall in tax revenue generated by a data center as they must prioritize the utility needs of their communities adding a NIMBY-ism aspect to potential new developments.

Long-term investors in the space may be less inclined to purchase assets in markets with lower supply barriers, akin to traditional real estate cycles where low barrier markets have fallen the furthest fastest. That being said, the profile of data center demand is segmented such that AI companies are less focused on the location and prioritize power costs, development timelines, and power availability. Real estate investors bullish on this demand segment may not worry about the low supply barriers. However, a more balanced approach may provide investors some protection from a potential AI-bubble and lead to long-term outperformance. So, which market stands to gain the most ground in the near term given the development headwinds?

The Dallas-Fort Worth market saw an all-time high ~450 MW of new deals come in during 3Q25. Similar to Northern Virginia, it has excellent connectivity and cheaper power. One advantage that Dallas has over other markets is the comparatively inexpensive land prices and an extremely pro-data center building regulatory environment. Coupled with a more attractive “time-to-power”, the central locale of Dallas / Fort-Worth provides for neutral latency (i.e., somewhat equidistant from the West and East coast). Recent developments and new commitments for the next five years could drive Dallas-Fort Worth to become the second largest data center market in the U.S.

New Markets Emerging

Investors are looking outside of the primary markets as competition for power and resources continue to heat up. Despite the strong 2025 leasing activity seen across the primary markets (~2,100 MW through 3Q), the majority of new deals in the U.S. were executed in ‘tertiary’ markets.

Shackelford County in West Texas (~125 miles West of Fort Worth) recently made headlines following Vantage Data Centers landmark 1.4 GW deal with Oracle and OpenAI at the planned ‘Frontier Campus’. The 1,200 acre campus is estimated to carry a total price tag of around $25 billion. Additionally, to bypass the energy regulatory body (Electric Reliability Council of Texas, or ”ERCOT”) power queue, developers are reportedly planning to generate their own power.

Reliance on utility grid-supplied power has become one of the most consequential aspects of getting a data center online. Some developers are looking to on-site power generation as the key to pushing past lengthy power connection queues. Creative solutions on such a large scale are likely to continue in these tertiary markets and may lead to the emergence of additional primary markets in the future.

Nathan Siino

—————————————————————————————————————————————