Industrial Outdoor Storage: A Beautiful Ugly Duckling

Industrial outdoor storage (“IOS”) is a niche commercial property type that has grown in popularity among institutions in recent years amid the broader industrial boom. Investor demand for IOS has been buoyed by strong recent operating results, favorable long-term supply demand dynamics, and a de minimis cap-ex burden. Research and data on the sector remain scarce, which can create opportunities.

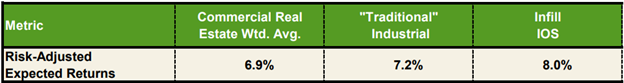

This report, entitled Industrial Insights - Industrial Outdoor Storage: A Beautiful Ugly Duckling, provides a high-level overview of key fundamental and valuation drivers of the IOS business. Green Street believes that IOS sites in infill submarkets are priced to deliver risk-adjusted expected returns that are superior to those available on most other commercial real estate property investments, including “traditional” industrial. Lower-barrier IOS does not sport the same favorable supply and demand attributes and expected returns are more likely middle-of-the-pack relative to all commercial real estate.

Industrial Outdoor Storage 101

The simplest definition of IOS is a land site zoned for an industrial use where the tenant can store something outside, most commonly vehicles, construction equipment, building materials, or containers. Most IOS sites have a small building that is generally used as an office and to store tools / parts required for the tenants’ operations. Typical IOS sites range from two to ten acres of land with a small building (~10k s.f.) in the front center of the parcel. The building to land ratio, or FAR, is generally less than 20%.

IOS also includes truck terminals, which are specialized, low-coverage industrial facilities designed for the maximum throughput of goods. Truck terminals are cross docked facilities where a long-skinny building resides near the center of the site. Goods are not stored in truck terminals but rather moved from one truck to another in the most efficient manner possible. Less-than-truckload (LTL) third-party logistics operators, which combine multiple customers’ freight on a single truck for at least the long-haul portion of the journey, are large users of truck terminals.

Most players in the space do not consider consumer storage yards for boats and RVs as IOS given they have an entirely different tenant base and are more operationally intensive.

IOS is a fragmented industry with most of the total stock not owned by institutions or specialized operating platforms. Users and ‘mom and pops’ own more than half of IOS sites in the U.S. This creates opportunity as there is often rent and NOI upside when purchasing from less sophisticated owners, but also makes aggregating in scale a challenge.

Lease structures are generally comparable to traditional industrial with triple-net leases that often have five, seven, or ten years of term with three percent or higher annual rent escalators. However, many of the non-institutionally owned sites can have shorter lease terms and/or lower escalators.

Demand Profile & Quality Considerations

The transportation and logistics sectors are the biggest users of IOS space. Third-party logistics companies (3PLs) utilize truck terminals for (de)consolidating goods and less specialized IOS sites for vehicle, chassis, and container storage/repairs. Proximity to seaports, intermodal hubs, airports, and highways are the main attributes 3PLs weigh when assessing the desirability and feasibility of IOS sites. Ultimately, 3PLs’ willingness to pay rent is determined by the transportation savings the site could provide versus not signing the lease or taking IOS space farther removed from critical supply chain infrastructure.

Prologis estimates transportation represents 45% to 55% of total supply chain costs for logistics tenants while warehouse/IOS rent represent ~5%. This dynamic suggests that a 1% reduction in transportation and labor costs equates to a ~15% increase in rent paying ability. Given approximately zero net new supply of IOS sites near logistics nodes, which is discussed in more detail in the subsequent section, demand and rent growth for well-located IOS should remain robust over time.

Building attributes for truck terminals are less important than traditional industrial, especially clear heights, given these are high throughput facilities where product is only stored on the floor for several hours at most. Complex racking systems and automated equipment are not required. The main building attributes for truck terminals are the number of dock doors (more is better) and the size of truck courts to avoid congestion and possibly offer trailer/container storage.

Other noteworthy use cases for IOS include construction equipment and building materials such as lumber, plumbing, and roofing. For these tenants, proximity to customers and job sites is more important than proximity to supply chain infrastructure.

Container storage was a key source of demand when numerous global supply chain disruptions, such as port congestion, truck driver shortages, China lockdowns, etc., created havoc in the transportation industry. IOS demand from container storage has begun to normalize from these peak Covid levels. Further, many class ‘A’ industrial facilities offer large truck courts with ample space to meet the container and trailer storage needs for most users during “normal” times.

A potential future source of demand could come in the form of charging lots for electric commercial vehicle fleets such as trucks and delivery vans. However, the power requirements are immense for this use and most locations do not have the power capacity to charge an EV fleet. Landlords and tenants would then need to work with the local utility provider to improve the electrical infrastructure, which adds cost, time, and complexity to any lease transaction.

Supply Picture & Zoning Constraints

The supply outlook for infill IOS appears to be one of the most attractive in all commercial real estate due to several factors: 1) vacant land is effectively non-existent near most logistics hubs; 2) entitlements are even harder to come by than traditional industrial; 3) a portion of the IOS stock is developed into traditional industrial or a different higher-and-better use each year.

For a full copy of the Industrial Insights - Industrial Outdoor Storage: A Beautiful Ugly Duckling report, subscribe to Green Street’s Research: https://www.greenstreet.com/contact-us.

Learn more about our insights

Our thought leadership helps thousands of clients make better investment decisions every day. Inquire here to learn more about Green Street’s product suite.

More Stories

Sector Outlooks

Hotels Bouncing Back From Tough Times With U.S. Lodging Outlook

Retail Sector

U.K. Retail Analytics Pro Health Index 101

Pan-European Forecast